Asset swaps in the energy sector: old rules for the old game

Asset swaps in the energy sector: old rules for the old game

Asset swaps (transactions of mutual exchange of property rights for previously matched assets) are concluded within the strategy of supporting the internationalisation of Russian energy companies. In fact, it is one of the few tools available of actual implementation of this strategy. Therefore, the issue of acceptance of asset swaps mechanism will remain high on the agenda in Russia’s energy trade discussions and negotiations, including its posture in relation to the Energy Charter Treaty; these discussions are now rolling out again in Brussels in the light of the ECT expansion and outreach activities. Importantly, all major examples of international cooperation with Russia in energy sector are based on (or supported by) asset swaps. In the current era when the energy sector is undergoing a serious transition, this mechanism of interactions between companies of various types is of specific interest.

|

| Robert Dudley, CEO of BP, and Eduard Khudainatov, president of Rosneft, marked a share swap in January 2011 (c) The Telegraph |

Proposition: ‘promote asset exchanges within investment activities in the energy sector’

On April 21, 2009, the Russian Federation presented the Conceptual Approach to the New Legal Framework for Energy Cooperation [note 1]. The proposed New Legal Framework “would include all major energy-producing (exporting) countries, countries of transit, and energy consumers (importers) as its Parties and cover all aspects of global energy cooperation”; the document states that “it would be advisable to elaborate a new universal international legally binding instrument” to reflect what could be described as drawbacks of the “existing Energy Charter-based system”.

| Russia and Europe are set to stay partners for decades to come, and thus issues such as this one have to be dealt with |

Judging from the Energy Strategy of Russia, one of the basic external goals for the oil and gas industry is wider presence of Russian energy companies on the international markets and participation in production, transport and distribution assets abroad. Further integration of the Russian energy sector into international energy system, maintaining its presence on existing markets and expanding into new markets, diversifying exported products while strengthening new forms of international cooperation and expanding presence of Russian energy companies abroad are core conditions for this strategy implementation [note 2]. Russian energy companies, in their turn, are rather interested in foreign projects and pursue various projects (E&P as well as other activities along the value chain) across the Globe, either independently or in collaboration with partner organisations within the framework of joint ventures and consortia.

Table 1. International activities of the Russian companies

| Company | Region | Projects |

| Gazprom | Europe | Downstream |

| America | Upstream | |

| Asia | Upstream | |

| CIS | Refineries, gas stations | |

| CEE | Refineries, gas stations | |

| Lukoil | CIS; CEE; MENA; America | Upstream; acquisitions along the value chain |

| Rosneft | CIS | Upstream |

| Europe (Germany) | Refinery | |

| Asia (China) | Refinery | |

| TNK-BP (acquired by Rosneft in 2013) |

Latin America | Upstream |

| Asia (Vietnam) | Upstream | |

| CIS | Gas stations | |

| Novatek | MENA (Egypt) | Exploration |

Table 2. What do their counterparties need? [note 3]

| Counterparties need: | Russian companies can provide: | |

| Capital | Capital | |

| New technologies and expertise | Some technologies | |

| Access to the final market and to distribution channels | - | |

| Skills: | Complex governance and project setting that involves IOCs, and different types of NOCs | - |

| Collaborative project development process | - | |

| Management of stakeholders and the mitigation of political and social risks in a complex project | Political support of the stakeholders in the certain countries; regional and cultural proximity | |

| Management of complex global subcontracting hierarchies | - | |

| Selecting, engaging and/or managing correct joint ventures agreements that deliver both commercial success and protect the company against costly dispute | - | |

Most of the internationalisation strategies of Russian companies are opportunity-driven, and despite the wide range of possible spheres of collaboration, the main value brought to the recipient country is capital. This makes the asset swap mechanism about the only tool available for Russian companies to deepen international cooperation and to propose something attractive (on top of the capital availability) to their foreign partners. At the same time, in the European context, asset swap transactions are often seen as concerning (most often concerns are in line with anti-monopoly regulation), hence one of the external objectives of Russia’s energy strategy is to promote asset swaps and make them less contradictory in the eyes of the European governments and regulators.

The issue of asset swaps is not a novelty in international energy business and, obviously, goes beyond the framework of Russia-EU energy relations. National and international energy companies from around the world are looking into the possibilities of asset exchanges in the target markets, and some are actively implementing these transactions.

Managing risks

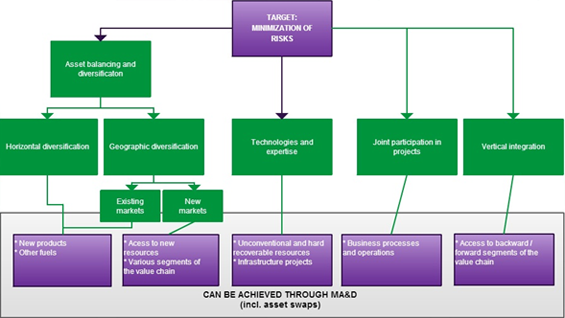

Asset swaps can be regarded as a part of portfolio management, which includes activities involving company’s assets and securities with the purpose of achieving specific investment goals.

| Most of the internationalisation strategies of Russian companies are opportunity-driven |

- A mix of frontier exploration and known field development (greenfield vs. brownfield);

- A mix of oil and gas;

- A mix of upstream, midstream and downstream assets;

- A mix of geographical locations to broaden political risk and to access different markets.

Figure 1. Minimization of risks: areas where MA&D (and asset swaps) are relevant

Is there a reason for concern?

Energy sector is characterised by high degree of investment specificity (firstly, assets have fixed location and cannot be moved; secondly, equipment is engineered for a specific project; thirdly, the infrastructure is constructed in order to connect a fixed set of participants), which might lead to opportunistic behaviour by one of the business parties. Thus, measures that help to establish strategic partnership relations between companies are useful in these circumstances.

Asset swaps within the internationalisation strategies serve as a tool available for the companies (along with regular transactions of acquisitions, mergers, divestments), and therefore should be treated accordingly. Of course, just as other transactions, they may lead to the outcomes unwanted by the regulators. However, without this mechanism, the external energy strategy implementation would be significantly more difficult for Russia. Marginalising Russia and leaving it away from the system of the international energy relationship and mutual investments does not seem to be a good and productive strategy.

One of the examples of asset swaps use within strategic cooperation is the internationalisation strategy of Rosneft, which has used asset swap transactions in its relations with BP, Statoil, and most notable, ExxonMobil. After signing the Strategic Cooperation Agreement with ExxonMobil in 2011, Rosneft and the supermajor have formed joint ventures in order to develop fields in Kara sea

| For the Russian companies, asset swaps are an additional guarantee of loyalty from the international counterparties |

For the Russian companies, asset swaps are an additional guarantee of loyalty from the international counterparties. Without this sort of guarantees, Russian business is not likely to get actively involved into international cooperation. Therefore, currently the topic of asset swaps is one of the key elements of Russia-EU cooperation. The future of energy cooperation in general, which we believe is of utmost importance to both sides, depends largely on how asset swaps will be viewed and perceived from the European side.

|

This article draws on the background study “Analysis of mutual exchanges of business assets within investment activities in the energy sector”, which was initiated by the Energy Charter Secretariat (ECS) and jointly implemented by the Energy Research Institute of the Russian Academy of Sciences and the ECS in 2013. The outcomes will be made public in the course of 2013 on the ECS website. Irina Mironova is an analyst at the Energy Research Institute of the Russian Academy of Sciences and a visiting fellow at the Energy Charter Secretariat. |

- Conceptual Approach to the New Legal Framework for Energy Cooperation. Goals and Principles. 2009, April 21. http://archive.kremlin.ru/eng/text/docs/2009/04/215305.shtml

- Energy Strategy of Russia for the period up to 2030.

- Mitrova Tatiana. Investment and export opportunities for Russian companies in oil and gas projects abroad: asset swaps as a method of developing direct foreign investment. RPGC 2013. June 25, 2013.