European gas market reforms undermine security of supply

European gas market reforms undermine security of supply

Market reformists who are trying to put an end to oil-indexed gas contracts fail to understand the unique value of the current "hybrid" pricing system Europe enjoys in the gas market. If they get their way, Europe will lose the protection of long-term contracts altogether and will move to a purely hub-based short-term pricing model as exists in the US, warns Sergei Komlev, Head of Contract Structuring and Price Formation at Gazprom Export. This model, he says, is not suitable for an import-dependent market like Europe. It will leave Europe at the mercy of short-term market forces without any regard for security of supply.

|

| Sergei Komlev, Head of Contract Structuring and Price Formation at Gazprom Export (c) Gazprom |

We often hear today that Gazprom is fighting a losing battle to preserve its oil-indexed contracts at a time when Europe is moving at high speed and with great enthusiasm to hub-based pricing.

In reality, however, there is no reason why oil-indexed and hub-based prices cannot continue their historic synergistic relationship, in other words coexist peacefully and with mutual benefit. Any real or perceived conflict between the two can be mitigated if properly handled. In fact, I am convinved that European hubs will flourish in the 'shadow' of oil-indexed long-term contracts.

The pricing model that currently exists in the European gas market is best described as "hybrid". It consists of a combination of mainly oil product-indexed long-term contracts and short-term hub pricing. I use the term hybrid to indicate that these two different pricing methods do not exist in parallel worlds. They are closely interconnected and operate as a single, unique, mechanism.

Under the existing model, oil-indexed prices play a leading and dominant role, while hub prices play a balancing and subordinate role. Together, they comprise a purely market-driven and highly competitive system, although competition manifests itself in a different way compared to the U.S. supply-demand pricing model. What I will try to demonstrate is that the Continental European market not only has its own unique organization but is already mature enough to perform the functions that it is designed for. There is no cause for an inferiority complex on the part of the Europeans, which seems to be one of drivers of the proposed changes to the market model.

The term hybrid is not my invention. A 2008 paper from the Clingendael International Energy Programme, part of the Clingendael Institute of International Relations in The Hague, uses this term to describe the pricing system in Continental Europe. This paper "concludes that there is no strong evidence that the current hybrid situation, in which both forms of gas pricing co-exist, cannot continue. There are also no overriding reasons to intervene in the market practices of price formation. Both systems have their advantages and disadvantages under different market conditions, and to some extent complement each other in the current markets. Different types of risk and the appreciation thereof by the trading parties will determine particular choices of pricing rules and contracting conditions". I do not know whether the folks at Clingendael still stand by the conclusions they made in 2008, but I fully agree with the statements made in this paper.

Push and pull

However, what we are witnessing now in Europe is a concerted attempt to displace oil-indexed prices with hub-indexed prices and, as a result, demolish the existing hybrid model. There are two different strategies which are being pursued to bring oil-indexation to an end - one could be named 'pull' and the other 'push'.

The 'Pull' strategy is an evolutionary one. It suggests that a transformation of the hybrid pricing model could be carried out gradually, simply through increasing the share of the spot component in the long-term contracts at the expense of oil indexation. The second 'Push' strategy employs arbitration as a means to put an end to oil-indexation in long-term contracts forever. These are to be replaced by 're-engineered' hub-linked long-term contracts under which supplier obligations remain the same.

I am convinced that neither strategy will be acceptable to suppliers. Existing long-term contracts are

| The Continental European market not only has its own unique organization but is already mature enough to perform the functions that it is designed for |

Indeed, if hubs are liquid enough, there is no need for a supplier to get into long-term contract obligations. At the very least such contracts should be changed to allow the seller to divert flows to other places when prices do not meet his expectations. In effect, then, if the existing sytem is destroyed it means it will be replaced by a purely short-term hub based system, as exists in the US. The question is whether this is the best option for import-dependent Europe.

Fake imitation

What we often hear nowadays is that Europe has reasonably liquid hubs, especially in the North-West, and spot prices are integrated enough to serve as indicators of the total European supply and demand balance. Thus, it is argued, these freely set hub prices can be substituted for oil products in the price formulas in the long-term supply contracts. In accordance with this viewpoint, our clients are increasingly demanding such substitution, and are calling for day-ahead, month-ahead, or year-ahead hub-link indexes, or various forward gas prices to displace oil-indexed prices.

Although we understand the interests behind these proposals, we can only say that a move towards supply and demand pricing desired by so many cannot be accomplished because the existing hub prices on the Continent are not a function of total supply and demand. Although prices on hubs are determined by supply and demand, hubs maintain equilibrium of only the residual volumes that remain after long-term oil-indexed contacts meet the bulk of demand.

Therefore, Continental hub pricing is not a function of total supply and demand but a function of something quite different: balancing and arbitrage of all kinds, between different contract pricing structures, between contract and spot prices, between hubs, between the UK and the Continent. In fact, the market in Continental Europe is an ideal stage for arbitrage. Although hubs can be reasonably liquid it does not mean that they serve as universal price indicator.

Let us call things by their proper names. In contrast to North American hubs, hubs in the hybrid pricing model do not provide a true indication of the supply-demand balance but only a fake imitation of it. But the hub price is a perfect instrument of all kinds of arbitrage, a role delegated to it by the hybrid model.

Quick fix

The relationship between hub and contract prices within a hybrid pricing model may best be described by the mathematical term "asymptotic". The asymptote in our case is the distance between the contract and hub prices.

Once the importers who typically hold long-term contracts with multiple suppliers have exercised arbitrage options, they set up a price ceiling as a benchmark for the whole market. Hub prices tend to settle at a discount to the contract prices. Hub prices may cross the contract price line, yet that constitutes the exception rather than the rule.

That asymptotic relationship explains a paradox of the UK hub prices. UK prices are formally completely 'delinked' from oil prices, but they are nonetheless driven by oil indexes, which is not the case with

| We fully understand our clients who tell us that they do not care about theoretical pricing models but prefer spot-priced gas because it is cheaper |

In recent times many observers have complained that long-term oil-indexed contract prices have been higher than spot prices. But a major reason for this price difference is the value of flexibility provided by long-term pipeline suppliers. Hubs offer standard lots with no flexibility. A good question is "what should be the price for this flexibility?" One, two, or maybe even three dollars per MMBTU?

A second reason why spot prices usually lag behind contract prices is the existence of one-sided balancing on hubs. In the case of a short-term undersupply, it is more convenient to use the existing long-term contract arrangements for securing additional deliveries. In the case of oversupply, selling gas at hubs is a quick-fix. A good example of a one-sided fix is the Finnish market, a "gas island" with lower prices on a small hub than those coming from one single supplier under long-term contracts.

The third reason for the difference between hub and long-term contract prices is the availability of flexible LNG that is rerouted from the US and cheap gas from the UK that arrives to the Continent through the Interconnector.

In the few cases when spot gas is more expensive than contract gas on the Continental market, it is a result of the inadequate capacity of the gas infrastructure at a time of strong demand for gas like in February of this year. The more developed this infrastructure is and the more integrated the EU domestic market is, the rarer will be instances when spot prices rise higher than contract prices.

It follows that gas producers clearly cannot accept a proposal to make contract and spot prices comparable by lowering contract prices. In most cases, spot prices will respond immediately by decreasing further. That is, any further decreases of oil-indexed contract prices accomplished by decreasing the base price or increasing the component indexed to hub pricing would result in a new cycle of downward adjustment in the spot price. Contract price reduction may make sense only in case it increases off-takes under long-term contracts. This is likely to occur only when there are other suppliers that are hesitant to deliver gas at a reduced price.

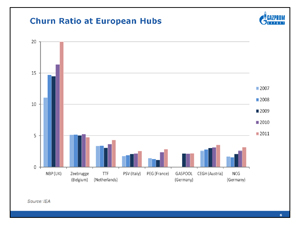

Churn ratios

|

| Churn ratio at European hubs (click to enlarge) (c) IEA |

Some analysts say that low churn ratios on the Continent are a reflection of the transition phase, and that, as hub markets mature, churn ratios will grow. I am pessimistic with respect to the further virtualization of the hub trades. It is not because there is a lack of appetite on behalf of European financial institutions to play with the forward curve. But it is extremely hard to predict what the price on a balancing market will be in two or three years because these prices are not about supply and demand but rather about arbitrage opportunities. There are too many moving parts in the balancing market that must be taken into consideration. To establish a rational forecast for a period of time extending more than 9 months appears to be a "mission impossible".

On the Continent the available financial instruments usually offer hedging opportunities that are limited in duration to only six to nine months. It is no coincidence that the maturity of forward instruments equates to a base period in the long-term supply contract formulas. Prices of long-term contracts for oil-indexed formulas are usually quite predictable.

Competitive advantages

The existing market structure on the European Continent is, at a minimum, satisfactory in that it offers win-win options for both buyers and sellers. However, the balancing nature of the Continental market has to be taken into consideration by major players, including regulators.

We fully understand our clients who tell us that they do not care about theoretical pricing models but prefer spot-priced gas because it is cheaper. However, when we tell them to buy more from hubs to lower the average price of their portfolio, they say that they cannot fully rely on hubs as their source of supply and would still prefer to get gas from us but at a gas-indexed price.

But we cannot support market reforms that are conducted without a full comprehension of their consequences. Reformists should be careful when giving competitive advantages to one group of

| Reformists should be careful when giving competitive advantages to one group of market participants at the expense of another |

So far, competition enhancement policy has only divided European gas market participants. A broad group of market players has emerged that have no import contracts, bring no gas to Europe under long-term arrangements, and are not responsible for gas storage and deliveries. Advantages without responsibilities for this group of players results in unfair competition.

If market reformists are not pursuing an implicit aim of pushing importers out of the business, what they must do is to protect these holders of long-term upstream contracts from unfair rules of the game. Participants of end-user supply tenders should meet strict qualification standards including a requirement to have import contracts. That qualification is also important for security of supply purposes as many discount suppliers without import contracts have already gone out of business (like TelDaFax in Germany) because they were not able to keep their promise to deliver cheap gas when hub prices started to converge with contract prices.

Fragile balance

To conclude, unjustified demands of gas importers that producers should be fully responsible for price risks in long-term contracts alter the fragile balance of interests between buyer and seller. Pushing these demands will lead to nothing but the demolition of long term supply contracts. Indeed, if markets are liquid enough as the importers argue when pushing for hub-indexed pricing, there is no need for long-term supply contracts.

However, transitioning to the American model - of hub pricing without long-term contracts and direct sales by natural gas producers - is not a suitable option for Europe. As a matter of fact, Europe is increasingly import-dependent and there are oligopolistic structures on both sides of the market that will end up opening a Pandora's Box of endless conflicts.

With oil-indexation in place, consumers of gas in Europe are protected from any form of price manipulation by the dominant suppliers because none of these suppliers is able to influence the price of oil. It is not Gazprom but European companies that are fighting a 'losing battle' to adopt an American-style hub model that will undermine European security of supply.

|

Additional reading

|