Gazproms view on the new EU initiatives and Russian gas export

Gazprom's view on the new EU initiatives and Russian gas export

On November 18, Deputy Chairman of OJSC Gazprom’s Management Committee Alexander I. Medvedev gave a reaction to the New Energy Policy that was presented by the European Commission on the 13th of November 2008. You can read his speech below.

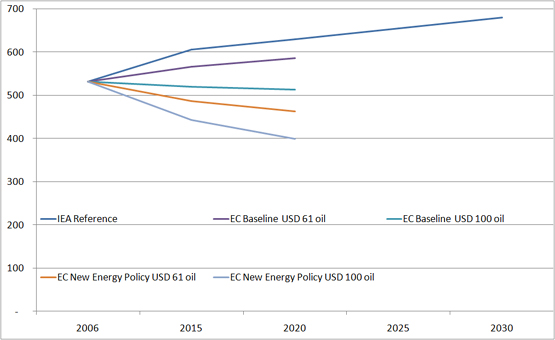

In the text a graph is presented that was drawn from natural gas demand forecasts by both by the IEA and the European Commission. You can also download two factsheets issued by Gazexport.

Gas Pricing Mechanism Factsheet

------------------------------------------------------------------------------------------------------------------------------------------

Speech of the Deputy Chairman of OJSC Gazprom’s Management Committee Alexander I. Medvedev at the VI International Forum “Russian Gas – 2008”, November 18, 2008, Moscow

Dear ladies and gentlemen!

Dear colleagues and friends!

First of all I would like to thank the initiators of the VI International Forum “Russian Gas – 2008” for the opportunity to give a speech at this honorable event.

The fundamental working principle of Gazprom is to act “on the basis of the market needs”, on the basis of the effective consumer demand for gas on the given market. In respect of export activities this means that first we enter into long term supply contracts envisaging “take-or-pay” obligations on the part of the consumer or “ship-or-pay” commitments on the part of the supplier: such contracts enable us to balance the risks between the buyer and the seller. Only then we define production volumes. Gazprom will produce exactly as much as consumers need, however, the company’s production capacity considerably exceeds the demand.

This is why in my speech, dedicated to Gazprom’s export potential, I would like to draw your attention to gas demand forecasts on the most important market in our view – the market of Central and Western Europe. Last year “Gazprom export” supplied to non-CIS countries 153,7 bcm of gas, including gas from third parties. In 2008 gas sales volumes to Central and Western Europe under “Gazprom export” contracts, are expected to amount to 161 bcm.

Discussions concerning the export potential to the European market have become currently central, especially when in September 2008 such important international organization as the International Energy Agency (IEA) presented a new forecast for gas demand in Europe.

In October 2008 Gazprom’s Board of Directors reviewed the finalization of the General Scheme for Gas Industry Development until 2030, considering the approval of the development strategies for Russian Industries and the General Scheme of Electric Power Plants Allocation until 2020, approved by the Government of the Russian Federation. In the framework of the General Scheme for Gas Industry Development we prepared a forecast for gas exports to European countries.

Last week the European Commission, while reviewing the EU Energy Security and Solidarity Action Plan presented the initiative named the New Energy Policy. The New Energy Policy represents an ambitious plan to reduce the EU’s dependence on energy imports, including natural gas imports.

Let me start with September forecast of the International Energy Agency. According to IEA, in 2020 EU and Turkey will import about 100 bcm of LNG and 500 bcm of pipeline gas. Some 240-280 bcm of these volumes are to be supplied from Russia, Asia and Northern Africa. Last year these regions supplied 175 bcm. Therefore, the demand for Russian pipeline gas in 2020 will range from 65 to 105 bcm. Following the forecast, without additional 86 bcm/year of throughput capacity of the planned Nord Stream and South Stream pipeline, Europe will just not get these volumes.

IEA forecast is close to our estimations. The draft of the General Scheme for Gas Industry Development until 2030, worked out by Gazprom and submitted to the Ministry of Energy for further approval, envisages that in 2020 pipeline gas exports from Russia to Europe will amount to 219 - 227 bcm, 189 bcm of which will be exported under existing or renewed contracts, while some 30-36 bcm will be supplied under new contracts and new projects. Thus, the draft of the General Scheme for Gas Industry Development estimated the demand for new pipeline gas in non-CIS countries in 2020 in the range between 65 to 73 bcm. As we can see, Gazprom’s and IEA’s estimations are quite close.

Let us return to the above mentioned New Energy Policy and EU Energy Security and Solidarity Action Plan, released by the European Commission on 13 November 2008 for public discussion. According to the European Commission, EU Energy Security and Solidarity Action Plan shall become a program document aimed to achieve the ambitious “20-20-20” target. This target of the New Energy Policy for 2020 envisages a 20% reduction of carbon dioxide emissions, the same 20% decrease in energy intensity and a 20% increase in the share of renewable energy resources in the overall energy balance.

According to the EC estimations published last week in the EU Energy Security and Solidarity Action Plan, through reducing the energy intensity and expanding renewables use, as well as reaching maximum production at gas fields in Europe itself, the EU will not need additional gas imports, particularly from Russia.

According to the EC forecast, if the oil price in nominal terms (at 2005 prices) reaches USD 100 per barrel, the overall gas imports to EU will drop in absolute terms by 14 bcm: down to 284 bcm in 2020 compared to 298 bcm in 2005. At a nominal oil price equal to USD 61 per barrel the need for additional imports will experience a moderate growth of 39 bcm and the overall imports will reach 337 bcm, which is twice as low compared to the IEA forecast.

|

| This graph represents the need for natural gas imports in the EU-27 in different scenario's by the International Energy Agency and the European Union. In the IEA reference case demand for imports keeps rising steadily. The EU scenario's are based on different oil prices. Higher oil prices result in a decline in gas demand. The NEP scenario predicts a demand for natural gas that is 170 - 230 Bcm below the IEA reference case. Figures are in Billion Cubic meters per year. Sources IEA Natural Gas Review 2008 and EU CEER2. |

How should Gazprom treat such forecasts? We cannot forget that here we deal with the EU official initiatives. By the end of this year the “20-20-20“ strategy, after discussions to be held, will be approved by the Council of Europe and the European Parliament.

We have mentioned more than once that we receive quite contradictory signals from our European partners concerning the issue whether Europe needs Russian gas or not. The EU Energy Security and Solidarity Action Plan, released last week, is another proof of such uncertainty.

Russia is the main supplier of gas and coal to EU markets and keeps the second position in oil supplies after OPEC, and we are quite astonished that the New Energy Policy does not give due importance to energy imports. The priority is more likely given to activities aimed at limitation of demand for Russian gas imports, while development of relations with Russia is among the main goals and objectives aimed to facilitate international cooperation in energy sector. The relations between Russia and EU stand in line with reinforcement of cooperation with African countries and OPEC, as well as maintaining closer contacts with other developed countries – which are big energy consumers - Australia, Canada, Japan and USA.

It is appropriate to mention a recent statement of the Russian Prime Minister Vladimir Putin at the joint press conference with the Finnish Prime Minister Matti Vankhanen: “Europe has to decide finally whether it needs Russian pipeline gas in the volumes that we offer or it does not… in case it does not, then we… will build gas liquefaction plants that will be working for the world market.”

It is time to turn to the subject matter of the New Energy Policy initiatives. We do not doubt the lofty aims to reduce greenhouse gases emissions to the atmosphere. But for some reasons the Europeans try to meet these objectives without concentrating on more active use of natural gas as the most environment-friendly fuel among all fossil fuels. On the contrary, limitation of gas imports, being a priority for the energy policy, impels some New Europe countries to confront a complicated dilemma. They are “torn” between the objective necessity to substitute retired capacity with modern gas generation plants and political phobias related to greater dependence on Russian gas supplies. Consequently, New Europe countries take steps intended to adjourn sine die the implementation of the goal to reduce emissions by 20%.

We cannot but be concerned about the methods to be used to increase the renewable energy share by 20% in the EU energy balance. At the times of the Soviet state-planned economy the government had at its disposal powerful instruments of direct administrative influence on the companies, but even these instruments did not always perform well. The EU does not possess such instruments. The price of kW/hour of electricity, generated from wind and sun energy, is known to be significantly higher than that of a CCGT plant. Moreover, it is evident to any expert that, due to the weather changes, sun and wind energy should be backed up by traditional energy resources.

What are the ways to make private businesses develop more expensive renewable energy? It is not excluded that the required standard for renewables use might be achieved by introducing additional taxes for gas, which are already high, and this will mean a suppression of demand for this fuel by applying administrative methods. As the final result, it will cause gas and electricity price escalation for final consumers. An important constituent of this price will be the failure of trust to Gazprom.

Despite the declared goals to decrease the dependence on imports, according to the authors of the New Energy Policy, it will prove impossible to lower the level of such dependence even provided that the ambitious “20-20-20” target is achieved, though in absolute terms import volumes will not grow. Reduction of dependence on gas imports in case the New Energy Policy goals are implemented, in comparison with the existing tendency of gas consumption, will amount to some 3,5 percentage points (71,1% and 74,6% respectively).

The President of the European Commission José Manuel Barroso in his presentation of the EU Energy Security and Solidarity Action Plan claimed that this plan is not directed against any country. Although the exact source of danger does not anyhow appear in the EU Energy Security and Solidarity Action Plan, it is understood that in the first place it is referred to Russia. But if the concept of the European energy security will be based on the myth of non-existing hazard of Gazprom, then this concept will inevitably approve activities which are, to put it mildly, devoid of sense. Thus, billions of euros will go to support a project, which is unreasonable in our opinion, to develop infrastructure that would provide the Baltic countries with gas from the West and by that to protect them from the imaginary hazard on the part of Gazprom, which is objectively one of the most reliable energy suppliers in the world.

So, will Europe need additional gas from Russia or not? Time will show. At least one conclusion emerges here. In the context of political and economic uncertainty Gazprom’s stake on executing long term contracts under “take-or-pay” terms has proved to be the right one.

Thank you for your attention.