Games Changers for LNG Markets in the East Mediterranean

September 09, 2015

on

on

This article explores the impact of global dynamics in natural gas pricing and regional game changers on the gas markets in the East Mediterranean. Putting Egypt, Israel and Cyprus in focus, the authors offer a snapshot of policy and market developments pre- and post-August 30th, when ENI’s major natural gas field discovery was announced. This way, the analysis below provides insights in such key questions What market environment do the new energy exporters find themselves in today? and what are the export routes that could bring the East Med gas to the European markets?

Since the beginning of this decade, LNG has been growing faster than any other source of gas, while last year LNG trade reached its second historical high, totaling some 241.1 MT - only 0.4 MT less compared to the 2011 post-Fukushima volumes. [1]

At the same time, due to the changing patterns on both the supply and the demand side, the LNG market is undergoing significant transformations, shaping a new environment for the emerging LNG exporters.

As the demand in the key importing counties in North-East Asia is slowing down and provided that the new volumes from the Pacific come on stream in due time, we can expect downward pressure on LNG prices. Over the last months, one can observe the convergence of spot LNG prices in the Asia Pacific and the Atlantic with the majority of spot transactions for September 2015 delivery being concluded at approximately $8.00/MMBtu.

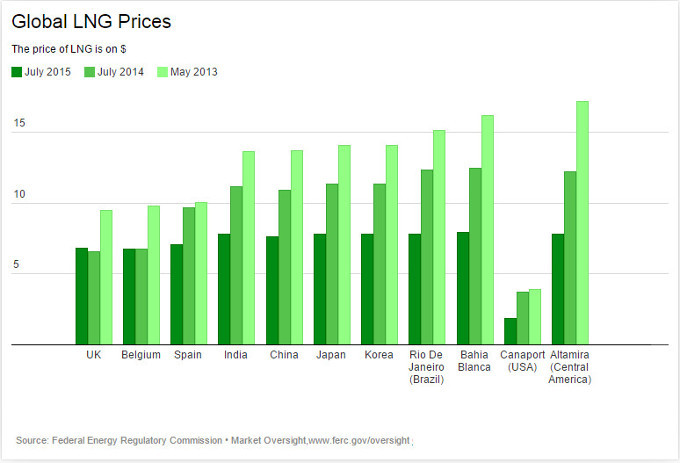

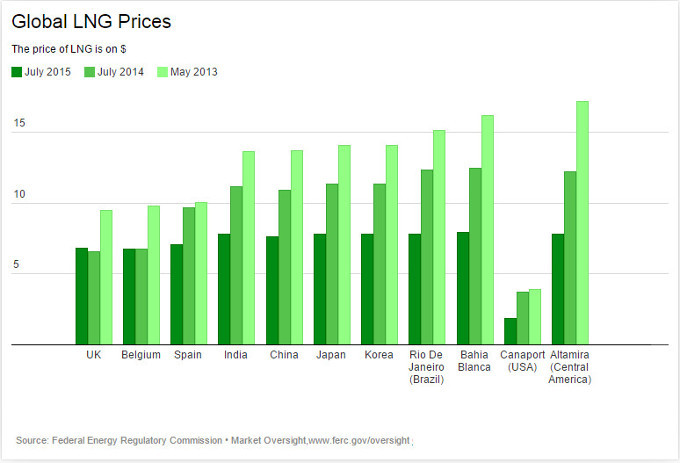

The chart below illustrates the dynamics of the global LNG prices from May 2013 to July 2015.

On a global scale, if in 2005 gas-on-gas (GOG) pricing accounted only for 13% of LNG imports globally, in 2014 it was 27%. [2]

Although the global LNG market is still dominated by oil-indexed import contracts (74% versus 26% GOG), GOG competition has been growing particularly in liquid Northwest European gas markets such as those of UK, Belgium, Denmark, Germany, Ireland and Netherlands.

A particular case to consider is the recent deal between Cheniere Marketing and EDF's (Électricité de France) to supply up to 26 LNG cargoes (some 100 million MMBtu) from the Sabine Pass LNG terminal in Cameron Parish, Louisiana to EDF's Dunkerque LNG terminal in France.

Apart from the obvious geopolitical element to it, this deal is interesting in terms of its contractual details. This is the first US LNG export contract with sales prices of a cargo unit linked to the Dutch TTF index [3] (with 6.60 $/mmbtu by 2018) instead of the US Henry Hub (3.30 $/mmbtu) and the first contract sealed on the DES (delivered ex-ship) basis for Europe.

The additional LNG volumes coming on stream from the US may therefore reach the EU in time to fill in the market niche, which is emerging due to the decline in production of the Groningen gas field in the Netherlands.

Moving to the LNG markets in South-East Europe and the Mediterranean (Greece, Italy, Portugal, Spain, Turkey), the decline in oil price resulted in a substantial increase of GOG pricing from 0 in 2005 to 36% in 2014. [4] Clearly, LNG glut has the potential to lift the share of GOG competition further up.

This brings us to the export options of the emerging LNG exporters in the East Med.

A Snapshot of the Regional Energy Balance Before 30 August 2015

Over the last six years, since the discovery of the Tamar and the Leviathan gas fields offshore Israel (which hold some 10 tcf (283 bcm) and 22 tcf (623 bcm) correspondingly), as well the Aphrodite gas field in the Cypriot Exclusive Economic Zone (EEZ) (holding 5 Tcf (141 bcm)), the two countries have been in the spotlight as regional exporters-to-be. The export markets targeted, particularly in the case of Israel, were those of Egypt, Jordan and potentially EU via Turkey.

As in the mid-2000s Egypt has turned from a net natural gas exporter into a net importer, and seeing the growing energy demand in the country, it was naturally an attractive market for exporters in the region.

With the recent progress in overcoming the political hurdles in Israel [5] and the announcement of Aphrodite gas field’s commercial viability, the energy companies operating in the region have continued to develop export strategies to deliver natural gas to Egypt.

In April-May 2015 a number of significant preliminary agreements were signed, promising exports to Egypt from Israel and Cyprus for at least 15 years to come. These letters of intent reinforced the political momentum to push for the internal agreement on gas exports in Israel, which had to be achieved before Noble unfreezes the Leviathan development.

For instance, in May an agreement of intent was signed between Noble Energy Inc. and Union Fenosa Gas SA to dispatch some 2.5 tcf from the Tamar gas field to Union Fenosa’s LNG facility in Egypt.

Another example is the preliminary agreement reached in June between the consortium operating the Leviathan gas field and Britain’s BG in Egypt to supply Israeli gas to BG’s LNG plant in Idku (northern Egypt) – a deal which could be worth some 30bn USD. [6]

Cyprus has also been actively working to secure the gas export deal with Egypt. According to the Cypriot ministerial statements, natural gas exports from Cyprus to Egypt could have become reality in some 2-3 years when the natural gas reserves in block 12 of the Aphrodite field enter the production stage.

In the beginning of August, the Energy Minister of Cyprus Giorgos Lakkotrypis mentioned that we are days away from seeing the results of the study concerning the transportation of natural gas from Cyprus’ Aphrodite field to the shores of Egypt.

The energy landscape in the region changed dramatically on 30 August 2015, when ENI announced its discovery of the “super giant” Zohr natural gas field offshore Egypt - the largest discovery ever made in the Mediterranean to date.

According to the spokesmen of Egypt’s Petroleum Ministry, the 30 tcf (849 bcm) gas field could be put in production in some 3 years from now, given the existing technologies, together with the onshore and offshore infrastructure available.

The Israeli energy minister already labeled this development as a wake-up call and “a painful reminder that while the State of Israel is standing still and taking its time with the final approval of the gas outline, and delaying further exploration, the world is changing before our eyes, also with ramifications on export possibilities.” [7]

Indeed, as of December 2014 the development of the Leviathan gas field was suspended by Noble due to the regulatory uncertainties, and even though the Israeli cabinet approved the long-awaited deal to develop Leviathan, there are still a number of regulatory hurdles to overcome before the agreement was authorized.

The Zohr discovery clearly challenges the development and monetization of Leviathan, depriving the proponents of the latter of the key argument in favor of approving the deal in the Israeli Parliament.

Without the export market in Egypt, the prospects for the Israeli gas exports seem rather grim, both due to the decline in natural gas and LNG prices expected in the decade to come, and the strong competitors in the region. One has to consider not only the production of the Egyptian gas in some 3 years from now, but also the timeline for the Iranian gas to enter the markets.

Apart from that, it seems that Jordan will no longer need the Israeli gas, as it could tap into the existing Arab Gas pipeline, which connects Egypt with Jordan, Syria and Lebanon (and has an underwater extension to Israel).

Europe, on the other hand, might benefit from the increasing production volumes in the region. Against the backdrop of the active negotiations between Cyprus and Egypt regarding natural gas trade, some high-level European energy officials have been voicing their concerns about the fact that the first Cypriot natural gas volumes will be exported outside the EU at times when gas supplies diversification is particularly high on the political agenda. Considering the Egyptian natural gas discoveries, this situation could be turned around completely.

Initially, the following options were mostly discussed to bring the East Med LNG to Europe: 1) to combine the Leviathan and Aphrodite volumes and ship LNG from the Vassilikos LNG facility in Cyprus; 2) to transport gas to Egypt, Idku, and re-export it to the EU (liquefying it, shipping to Europe and re-gasifying); 3) through a pipeline from Cyprus to Turkey.

Looking back at the current market environment, the commercial viability of exporting LNG from Cyprus and Israel to the European markets becomes questionable. At $11 per mmBTU LNG from the East Med would have tough competition with the volumes imported from the spot markets at $8.00/MMBtu on average. On top of that, once Egypt turns back to a net natural gas exporter, it would unlikely be willing to pay a premium for the imported gas volumes from Israel, so the re-export idea can probably be scrapped already.

This brings us to the option of exporting the Israeli and Cypriot gas via a pipeline to Turkey and then further to the European markets, which would be a commercially viable solution. The ongoing discussions regarding the solutions of the Cypriot question definitely give a positive signal in the direction of improving the geopolitical relations between the two countries.

At the same time, the proximity of Zohr to the Aphrodite gives hope for new discoveries in the Cypriot EEZ, which could improve the export potential of the country.

In the meantime, the commercially viable and politically neutral solution to export small volumes of natural gas (>5tcf) from Cyprus to Turkey seems to be Floating Compressed Natural Gas (FCNG).

A FCNG system typically costs 45% less than the cost of a FLNG vessel (with FCNG CAPEX being some $850/tpa and that of FLNG - $1,500/tpa). [8]

As the construction of the Coselle CNG ship was recently approved by the American Bureau of Shipping, this technological solution does make CNG an economical and flexible option for seaborne transportation of natural gas for distances of maximum 2,500 km.

It definitely has a strong advantage from a security perspective for the East Med region, as FCNG vessels can be located far from the coastline and therefore are not exposed to the same risks of terrorist activity as onshore infrastructure, LNG plants and pipelines, is. At the same time, the volume of gas that a FCNG vessel can transport is very modest (<5tcf).

Another variable that one has to consider is the come back of the Iranian gas on the international markets. If the intentions of Spain to receive LNG from Iran and sell it further to the European markets materializes, the competition in the region will be much more intense than predicted.

1. IGU Whole Sale Gas Price Survey Report, 2015 Edition

2. Ibid.

3. Cheniere Energy signs LNG sales deal with EDF, Hydrocarbons Technology, 12 August 2015

4. Ibid.

5. Israel Cabinet Approves Deal to Develop Leviathan Natgas Field, Reuters, 16 August,

6. ft.com

7. timesofisrael.com

8. Unlocking stranded gas with Floating CNG (FCNG) for smaller fields - By LNG Industry Magazine May 2014

Daria Nochevnik is European Energy Review's Chief Analyst Natural Gas, LNG and Integration of Energy Systems, Deputy Head of the Greek Energy Forum in Brussels, and an EU Energy Regulatory and Strategic Political Analysis Specialist .

Athanasios Pitatzis is Member of the Greek Energy Forum.

The opinions expressed in the article are personal and do not reflect the views of the entire Forum or the companies that currently employ the authors. Follow Greek Energy Forum on Twitter @GrEnergyForum.

This article is part of the knowledge partnership between European Energy Review and the Greek Energy Forum a group of energy professionals sharing common interest in the broader energy industry in Greece and South-eastern Europe.

Image: LNG Ebisu. By: MIDTAIL. CC-BY license.

Global Trends and Regional Dynamics

Since the beginning of this decade, LNG has been growing faster than any other source of gas, while last year LNG trade reached its second historical high, totaling some 241.1 MT - only 0.4 MT less compared to the 2011 post-Fukushima volumes. [1]

At the same time, due to the changing patterns on both the supply and the demand side, the LNG market is undergoing significant transformations, shaping a new environment for the emerging LNG exporters.

As the demand in the key importing counties in North-East Asia is slowing down and provided that the new volumes from the Pacific come on stream in due time, we can expect downward pressure on LNG prices. Over the last months, one can observe the convergence of spot LNG prices in the Asia Pacific and the Atlantic with the majority of spot transactions for September 2015 delivery being concluded at approximately $8.00/MMBtu.

The chart below illustrates the dynamics of the global LNG prices from May 2013 to July 2015.

On a global scale, if in 2005 gas-on-gas (GOG) pricing accounted only for 13% of LNG imports globally, in 2014 it was 27%. [2]

Although the global LNG market is still dominated by oil-indexed import contracts (74% versus 26% GOG), GOG competition has been growing particularly in liquid Northwest European gas markets such as those of UK, Belgium, Denmark, Germany, Ireland and Netherlands.

A particular case to consider is the recent deal between Cheniere Marketing and EDF's (Électricité de France) to supply up to 26 LNG cargoes (some 100 million MMBtu) from the Sabine Pass LNG terminal in Cameron Parish, Louisiana to EDF's Dunkerque LNG terminal in France.

Apart from the obvious geopolitical element to it, this deal is interesting in terms of its contractual details. This is the first US LNG export contract with sales prices of a cargo unit linked to the Dutch TTF index [3] (with 6.60 $/mmbtu by 2018) instead of the US Henry Hub (3.30 $/mmbtu) and the first contract sealed on the DES (delivered ex-ship) basis for Europe.

The additional LNG volumes coming on stream from the US may therefore reach the EU in time to fill in the market niche, which is emerging due to the decline in production of the Groningen gas field in the Netherlands.

Regional Markets in Focus

Moving to the LNG markets in South-East Europe and the Mediterranean (Greece, Italy, Portugal, Spain, Turkey), the decline in oil price resulted in a substantial increase of GOG pricing from 0 in 2005 to 36% in 2014. [4] Clearly, LNG glut has the potential to lift the share of GOG competition further up.

This brings us to the export options of the emerging LNG exporters in the East Med.

A Snapshot of the Regional Energy Balance Before 30 August 2015

Over the last six years, since the discovery of the Tamar and the Leviathan gas fields offshore Israel (which hold some 10 tcf (283 bcm) and 22 tcf (623 bcm) correspondingly), as well the Aphrodite gas field in the Cypriot Exclusive Economic Zone (EEZ) (holding 5 Tcf (141 bcm)), the two countries have been in the spotlight as regional exporters-to-be. The export markets targeted, particularly in the case of Israel, were those of Egypt, Jordan and potentially EU via Turkey.

As in the mid-2000s Egypt has turned from a net natural gas exporter into a net importer, and seeing the growing energy demand in the country, it was naturally an attractive market for exporters in the region.

With the recent progress in overcoming the political hurdles in Israel [5] and the announcement of Aphrodite gas field’s commercial viability, the energy companies operating in the region have continued to develop export strategies to deliver natural gas to Egypt.

In April-May 2015 a number of significant preliminary agreements were signed, promising exports to Egypt from Israel and Cyprus for at least 15 years to come. These letters of intent reinforced the political momentum to push for the internal agreement on gas exports in Israel, which had to be achieved before Noble unfreezes the Leviathan development.

For instance, in May an agreement of intent was signed between Noble Energy Inc. and Union Fenosa Gas SA to dispatch some 2.5 tcf from the Tamar gas field to Union Fenosa’s LNG facility in Egypt.

Another example is the preliminary agreement reached in June between the consortium operating the Leviathan gas field and Britain’s BG in Egypt to supply Israeli gas to BG’s LNG plant in Idku (northern Egypt) – a deal which could be worth some 30bn USD. [6]

Cyprus has also been actively working to secure the gas export deal with Egypt. According to the Cypriot ministerial statements, natural gas exports from Cyprus to Egypt could have become reality in some 2-3 years when the natural gas reserves in block 12 of the Aphrodite field enter the production stage.

In the beginning of August, the Energy Minister of Cyprus Giorgos Lakkotrypis mentioned that we are days away from seeing the results of the study concerning the transportation of natural gas from Cyprus’ Aphrodite field to the shores of Egypt.

The regional game changer

The energy landscape in the region changed dramatically on 30 August 2015, when ENI announced its discovery of the “super giant” Zohr natural gas field offshore Egypt - the largest discovery ever made in the Mediterranean to date.

According to the spokesmen of Egypt’s Petroleum Ministry, the 30 tcf (849 bcm) gas field could be put in production in some 3 years from now, given the existing technologies, together with the onshore and offshore infrastructure available.

The Israeli energy minister already labeled this development as a wake-up call and “a painful reminder that while the State of Israel is standing still and taking its time with the final approval of the gas outline, and delaying further exploration, the world is changing before our eyes, also with ramifications on export possibilities.” [7]

Indeed, as of December 2014 the development of the Leviathan gas field was suspended by Noble due to the regulatory uncertainties, and even though the Israeli cabinet approved the long-awaited deal to develop Leviathan, there are still a number of regulatory hurdles to overcome before the agreement was authorized.

The Zohr discovery clearly challenges the development and monetization of Leviathan, depriving the proponents of the latter of the key argument in favor of approving the deal in the Israeli Parliament.

Without the export market in Egypt, the prospects for the Israeli gas exports seem rather grim, both due to the decline in natural gas and LNG prices expected in the decade to come, and the strong competitors in the region. One has to consider not only the production of the Egyptian gas in some 3 years from now, but also the timeline for the Iranian gas to enter the markets.

Apart from that, it seems that Jordan will no longer need the Israeli gas, as it could tap into the existing Arab Gas pipeline, which connects Egypt with Jordan, Syria and Lebanon (and has an underwater extension to Israel).

Europe, on the other hand, might benefit from the increasing production volumes in the region. Against the backdrop of the active negotiations between Cyprus and Egypt regarding natural gas trade, some high-level European energy officials have been voicing their concerns about the fact that the first Cypriot natural gas volumes will be exported outside the EU at times when gas supplies diversification is particularly high on the political agenda. Considering the Egyptian natural gas discoveries, this situation could be turned around completely.

Initially, the following options were mostly discussed to bring the East Med LNG to Europe: 1) to combine the Leviathan and Aphrodite volumes and ship LNG from the Vassilikos LNG facility in Cyprus; 2) to transport gas to Egypt, Idku, and re-export it to the EU (liquefying it, shipping to Europe and re-gasifying); 3) through a pipeline from Cyprus to Turkey.

Looking back at the current market environment, the commercial viability of exporting LNG from Cyprus and Israel to the European markets becomes questionable. At $11 per mmBTU LNG from the East Med would have tough competition with the volumes imported from the spot markets at $8.00/MMBtu on average. On top of that, once Egypt turns back to a net natural gas exporter, it would unlikely be willing to pay a premium for the imported gas volumes from Israel, so the re-export idea can probably be scrapped already.

This brings us to the option of exporting the Israeli and Cypriot gas via a pipeline to Turkey and then further to the European markets, which would be a commercially viable solution. The ongoing discussions regarding the solutions of the Cypriot question definitely give a positive signal in the direction of improving the geopolitical relations between the two countries.

At the same time, the proximity of Zohr to the Aphrodite gives hope for new discoveries in the Cypriot EEZ, which could improve the export potential of the country.

In the meantime, the commercially viable and politically neutral solution to export small volumes of natural gas (>5tcf) from Cyprus to Turkey seems to be Floating Compressed Natural Gas (FCNG).

A FCNG system typically costs 45% less than the cost of a FLNG vessel (with FCNG CAPEX being some $850/tpa and that of FLNG - $1,500/tpa). [8]

As the construction of the Coselle CNG ship was recently approved by the American Bureau of Shipping, this technological solution does make CNG an economical and flexible option for seaborne transportation of natural gas for distances of maximum 2,500 km.

It definitely has a strong advantage from a security perspective for the East Med region, as FCNG vessels can be located far from the coastline and therefore are not exposed to the same risks of terrorist activity as onshore infrastructure, LNG plants and pipelines, is. At the same time, the volume of gas that a FCNG vessel can transport is very modest (<5tcf).

Another variable that one has to consider is the come back of the Iranian gas on the international markets. If the intentions of Spain to receive LNG from Iran and sell it further to the European markets materializes, the competition in the region will be much more intense than predicted.

1. IGU Whole Sale Gas Price Survey Report, 2015 Edition

2. Ibid.

3. Cheniere Energy signs LNG sales deal with EDF, Hydrocarbons Technology, 12 August 2015

4. Ibid.

5. Israel Cabinet Approves Deal to Develop Leviathan Natgas Field, Reuters, 16 August,

6. ft.com

7. timesofisrael.com

8. Unlocking stranded gas with Floating CNG (FCNG) for smaller fields - By LNG Industry Magazine May 2014

Daria Nochevnik is European Energy Review's Chief Analyst Natural Gas, LNG and Integration of Energy Systems, Deputy Head of the Greek Energy Forum in Brussels, and an EU Energy Regulatory and Strategic Political Analysis Specialist .

Athanasios Pitatzis is Member of the Greek Energy Forum.

The opinions expressed in the article are personal and do not reflect the views of the entire Forum or the companies that currently employ the authors. Follow Greek Energy Forum on Twitter @GrEnergyForum.

This article is part of the knowledge partnership between European Energy Review and the Greek Energy Forum a group of energy professionals sharing common interest in the broader energy industry in Greece and South-eastern Europe.

Image: LNG Ebisu. By: MIDTAIL. CC-BY license.

Read full article

Hide full article

Discussion (0 comments)